The 2024 season brought a mixed bag of challenges and opportunities for pool and spa retailers. Economic headwinds like inflation, rising interest rates, and growing online competition impacted consumer spending and overall revenue — with nearly half of retailers reporting a decline compared to the previous year. Yet despite these hurdles, the retail sector remained resilient and forward-thinking. In fact, more than half of respondents say they’re heading into 2025 with a sense of optimism.

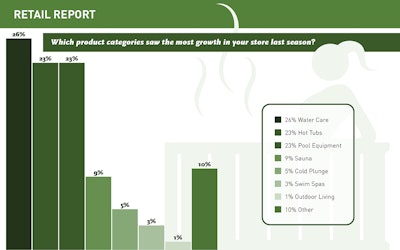

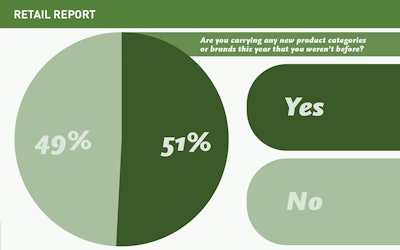

Retailers leaned into their strengths last year. Hot tubs, chemicals, and water care products drove much of the in-store action, while saunas, cold plunges, and swim spas continued to grow as part of the wellness movement. Nearly a third of businesses introduced entirely new product lines, and meeting consumer interest with fresh offerings and different price points offered new opportunities for growth.

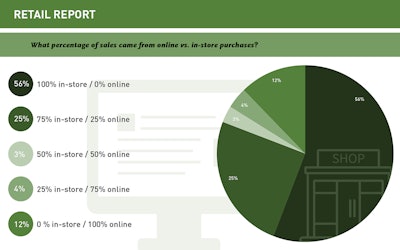

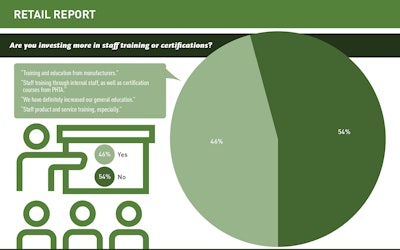

Although concerns remain, dealers are focusing on what they can control. Many have adopted leaner inventory strategies, invested in staff training, and expanded their digital presence through e-commerce platforms and BOPIS offerings. While a majority of sales are still happening in-store, those embracing hybrid models are laying the groundwork for future growth.

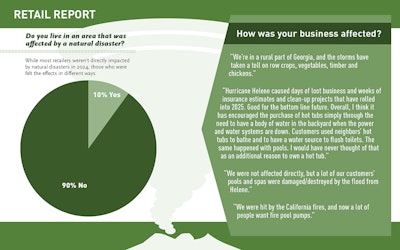

Pool and spa retailers also shared countless small wins and memorable moments — like the story of customers using neighbors’ hot tubs to bathe and provide water for toilets after a hurricane knocked out local water systems. “I would have never thought of that as an additional reason to own a hot tub!” one retailer reflected. It’s a powerful reminder that these products offer more than luxury — they provide comfort, connection, and even resilience in unexpected ways.

As the market continues to evolve, pool and spa retailers are meeting the moment — not by sitting still, but by adapting and capitalizing on what they do best. We invite you to read on for the 2025 State of the Industry Retail Report.

Part 1: The Business Landscape

Revenue & Retailer Sentiment

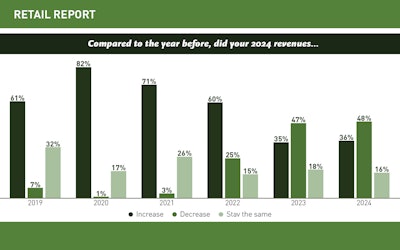

Following a prolonged period of growth, revenue declines became more common in 2024. Nearly 48% of retailers reported a dip — the highest percentage in recent years — while just over a third (36%) saw an increase. Compared to 2020, when only 1% of retailers experienced a drop, the contrast is stark. Still, the outlook remains positive, as 52% said they feel optimistic heading into 2025.

Outside Pressures & Their Effects

Retailers cited a number of economic concerns, including inflation, interest rates, internet pricing, and general consumer hesitation tied to the election year. Many pointed to discretionary spending decreases and tighter budgets across their customer base — especially for larger purchases like pools and swim spas.

Despite the squeeze, a few respondents noted unexpected growth or stronger-than-expected customer traffic, especially when tied to strong in-store education and product value.

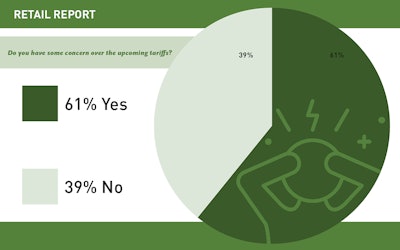

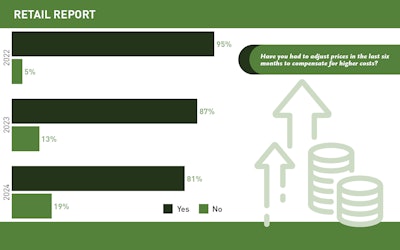

The rising cost of goods and looming tariffs were top of mind for many respondents, as 81% adjusted prices in the last six months to compensate for higher costs — and 61% expressed concern over upcoming tariffs.

Digital Presence & E-Commerce

Some retailers are leaning more into online options, such as growing their e-commerce presence or expanding buy-online-pickup-in-store options.

That said, 57% still reported 100% of their sales occur in-store — showing there’s room for growth in online strategies, even as digital advertising and re-marketing continue to gain traction.

The Customer Connection

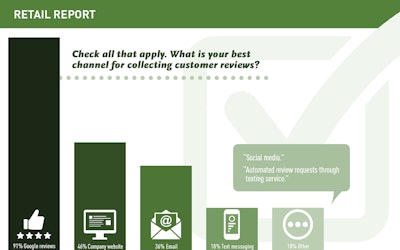

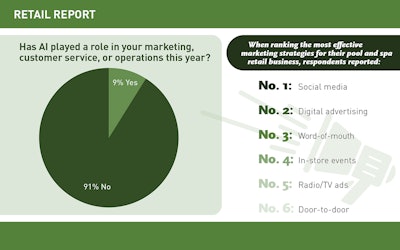

In a competitive market, strong customer relationships remain one of the most powerful tools in a retailer’s arsenal. From collecting feedback and fine-tuning marketing strategies to exploring new technologies, businesses are finding creative ways to build trust, stay top of mind, and meet customers where they are. We explore how pool and spa dealers are engaging with their audience — what’s working, where they’re investing, and how tools like AI and digital reviews are starting to shape the retail experience.

Part 2: Inside the Store

Product & Consumer Trends

As for which product categories saw the most growth in 2024, respondents pointed to a strong showing from core product lines. Water care led the way (26%), closely followed by hot tubs and pool equipment (both at 23%). While smaller in share, saunas (9%) and cold plunges (5%) continue to gain traction as retailers broaden their wellness-focused offerings. Swim spas (3%) also saw steady interest while outdoor living categories — including furniture and decor — remained niche at just 1%. An additional 10% cited growth in other categories, including service, inground pools, and renovation.

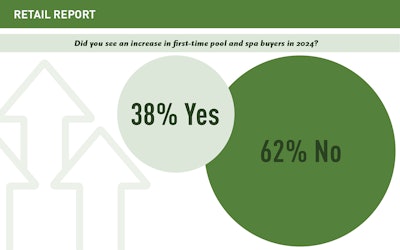

When asked whether they saw an increase in first-time pool or spa buyers in 2024, 38% of retailers said yes, while 62% reported no change. While this marks a slowdown compared to the surge of new buyers during the pandemic, it suggests that a healthy portion of the market is still being driven by new entrants.

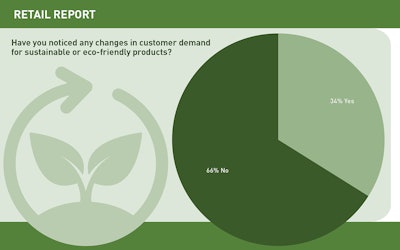

Interest in sustainable and eco-friendly products continues to grow, albeit slowly. Approximately 34% of retailers said they’ve noticed an increase in customer demand for green alternatives, while 66% reported no major shift. Among those seeing rising interest, customers were most drawn to energy-efficient hot tubs, chlorine-free systems, solar-powered equipment, and low-chemical water care options.

Today’s consumers are often well-researched before stepping into a store, but still rely on expert guidance to make confident purchasing decisions. Survey respondents noted that customers expect more personal recommendations, quick answers and ongoing support.

Spas, Accessories & Wellness Demand

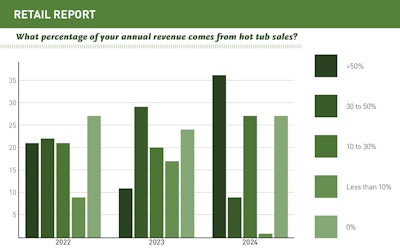

Hot tubs remained a steady performer, with many businesses reporting increased focus and customer interest in spa wellness and personalization.

When it comes to personalizing the spa experience, customers are most interested in the essentials — and the little luxuries. All survey respondents said customers ask for cover lifters and spa steps alongside their spa purchase, followed by covers and spa fragrances/conditioners.

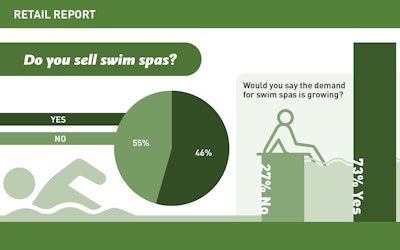

Just over half of surveyed respondents (55%) reported that they currently sell swim spas. The versatile product continues to occupy a unique space in the market — appealing to customers who want the benefits of both exercise and relaxation, often without the footprint or cost of a traditional pool. And many dealers remain optimistic about the growing category.

Part 3: Labor & Long-Term Outlook

Hiring & Recruitment

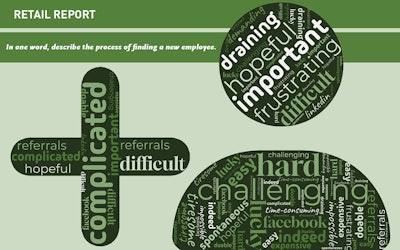

Hiring remains one of the top challenges for retailers. Words like “frustrating,” “impossible,” and “complicated” dominated responses to how it feels to find new employees — though a few called it “hopeful” and “doable.”

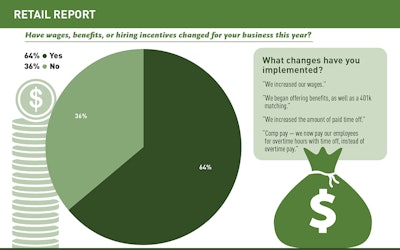

More than 63% reported increasing wages, benefits, or incentives to stay competitive, with some offering referral bonuses, PTO, or flexible schedules.

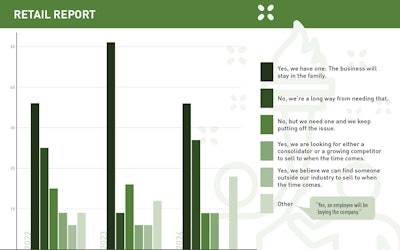

Does your company have an ownership succession plan?

As the industry continues to evolve, long-term business planning is emerging as a crucial, if often delayed, conversation, as 9% of survey respondents admitted to putting it off. But just over 36% said they have a formal succession plan in place to keep the business in the family, while 27% reported they’re a long way from retirement.

Challenges & Opportunities Ahead

Retailers are heading into 2025 with cautious optimism, but many acknowledge a range of challenges on the horizon. From economic pressures to staffing concerns and market uncertainty, business owners are preparing to navigate another complex year. Here’s what they had to say about the biggest obstacles they expect to face.

Still, opportunities abound. Retailers are focusing on categories like wellness, swim spas, renovations, and water care as areas for continued growth.

The future of the pool and spa market is a hot topic for many business owners, and predictions vary. While some foresee continued growth, others anticipate shifts in how and where products are sold. While changes are expected, the industry will continue to evolve — creating new opportunities for those who adapt and stay connected to their customers.